Retirement readiness: It’s all about income

October 31, 2024

by Rob Greenman, CFP® and Alex Canellopoulos, CFA, Vista Capital Partners

“Will I be financially ready to retire?” As financial planners, that is one of the most frequently asked questions we receive from clients—and it’s asked by people from a variety of backgrounds, phases of life, and net worth.

This uncertainty often influences when people take retirement and their lifestyle once they’re there. Some may decide to work longer than planned, either in a full- or part- time role. Others may live too frugally in their later years, worried about outliving their savings.

To combat these concerns, we look beyond conventional strategies to generate needed retirement income. Instead, we deploy a total return approach, combining multiple investment types, strategic capital gains utilization, and tax-efficient distributions to maximize income for people living in retirement.

The trouble with relying on income investing

Traditionally, fixed-income assets have been a popular choice for investors seeking income. This approach may work when yields are high, and investors are receiving the cash flow they need to cover their monthly expenses.

However, this strategy is not always effective for several reasons:

- When yields drop, investors may feel pressure to replace income. Some may tilt their portfolios toward high-dividend-paying stocks and/or high-yield junk bonds in an effort to maintain or improve cash flow. However, doing so simply trades short-term reward for long-term risk, which can potentially hurt investors in retirement when they need income most.

- Investors may be reluctant to diversify. While income-producing assets provide the money retirees need to cover expenses, they also need growth-focused assets to ensure their savings can keep up with inflation. A portfolio that’s weighted too heavily in dividend-paying stocks and fixed income assets such as bonds may not keep pace with inflation, ultimately resulting in a savings shortfall.

- Markets don’t always move as planned. Some financial plans may be based on too-high growth assumptions. If assets underperform, investors may find themselves with a cash flow shortfall that requires them to dig deeper into their savings, putting them at risk of outliving their retirement funds.

The total return approach to retirement income

We mitigate these risks by utilizing a well-diversified portfolio designed to generate income through a combination of sources, including:

- Dividend income (from stocks and REITs)

- Bond interest

- Capital gains (from selling appreciated investments)

- Occasional access to principal

This move away from over-reliance on dividend-paying stocks is based on work by Eugene Fama and Kenneth French, leaders in modern finance. Fama and French developed an asset pricing model identifying three common factors in outperforming stocks: how vulnerable a stock is to a market drop, company size, and company valuation.

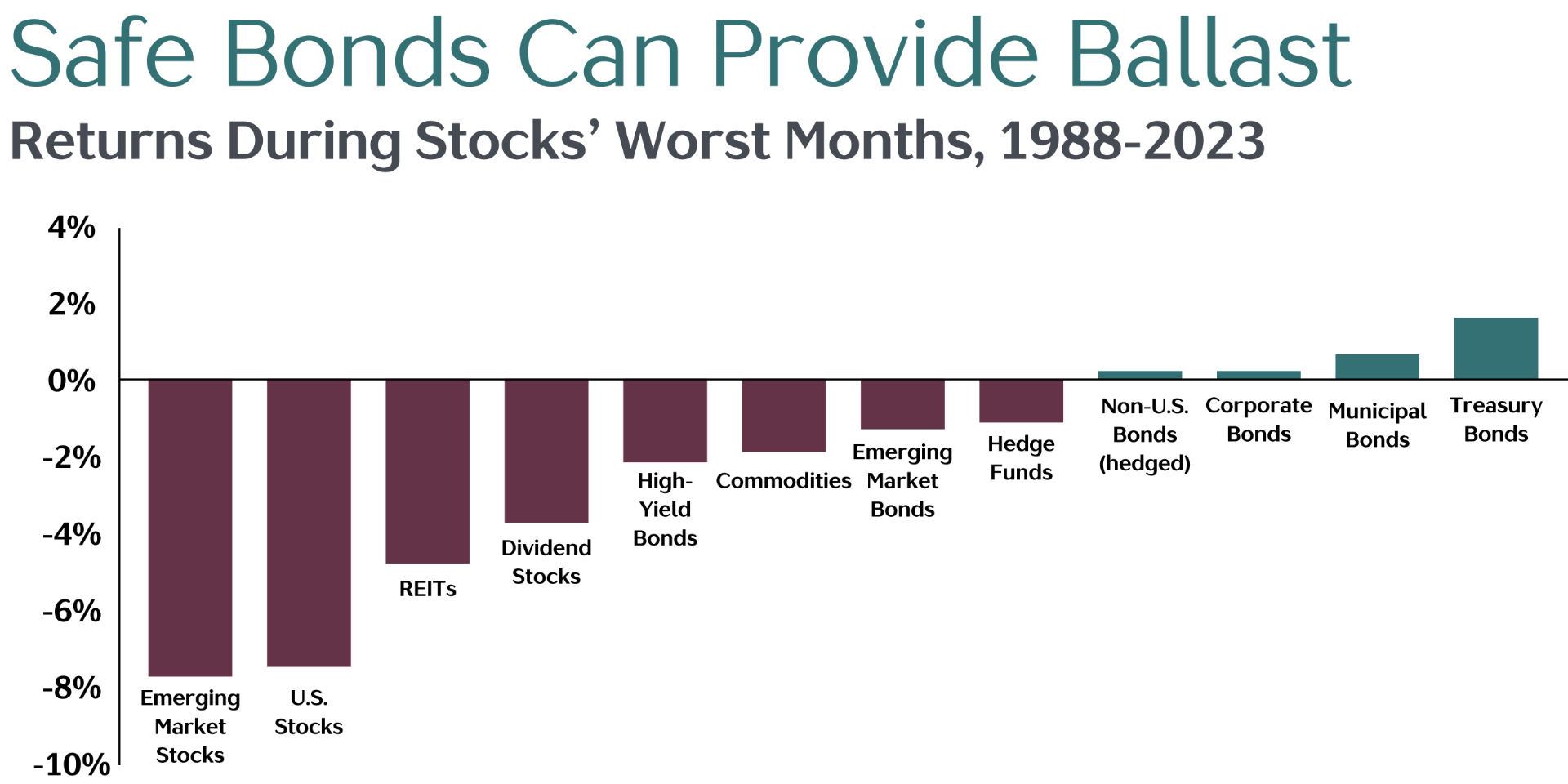

With this framework in mind, we typically tilt our clients’ portfolios toward small and value companies with the objective of increasing returns. We then supplement equity income by adding safe bonds to the portfolio, which can add ballast in years when equity markets underperform.

Source: Vanguard. Median return for various asset classes during the bottom 10% of monthly U.S stock returns, 1988 - 2023. U.S. Stocks represented by Russell 3000 Index, Emerging-market stocks represented by MSCI Emerging Markets Index, REITS represented by Dow Jones US Select REIT Index, Hedge Funds represented by Credit Suisse Hedge Fund Index USD, Dividend Stocks represented by Dow Jones US Select Divided Index, High Yield Bonds represented by Bloomberg Barclays US Corporate High Yield Index, Emerging Markets Bonds represented by JP Morgan EMBI Global Diversified Index, Commodities represented by Bloomberg Commodity Index, Corporate Bonds represented by Bloomberg Barclays US Corporate Bond Index, Municipal Bonds represented by Bloomberg Barclays Municipal Index, Non-US Bonds represented by Bloomberg Barclays Global Aggregate ex USD Bond Index, Treasury Bonds represented by Bloomberg Barclays US Treasury Index. The Dow Jones U.S. Select Dividend Index starts in January 1992; JP Morgan EMBI Global Diversified Index starts in January 1994; Credit Suisse Hedge Fund Index starts in January 1994 and Bloomberg Barclays Global Aggregate ex USD Bond Index starts in January 1990.

This chart looks at the worst periods for US stocks (as measured by the bottom 10% of monthly returns for U.S. stocks from 1988 through 2023) and showcases how other asset classes have behaved in those same months.

In other words, it answers the question: which asset classes best protect a portfolio when U.S. stocks fall?

As the graphic displays, safe bonds such as U.S. Treasury and high-quality international government bonds have historically provided the best protection from severe stock

market stress.

In the years when clients need additional income, we may consider selling appreciated assets or tapping into principal. This is where tax planning really comes to the forefront, as capital gains and distributions from taxable accounts may increase retirees’ tax liability.

Setting withdrawal rates

Withdrawal rates play an important part of a retirement plan, since they directly impact cash flow and portfolio longevity. The rule of thumb is that investors with balanced portfolios can expect to withdraw 4-5% each year without worry of outliving their savings.

With conventional investing strategies, a withdrawal rate of 4-5% isn’t always sustainable. For example, bond-heavy, conservative portfolios historically haven’t lasted with a 4-5% withdrawal rate. On the flip side, portfolios with an 80/20 stock-to-bond ratio can sustain withdrawal rates between 6-7%—but they also introduce additional risk of loss if markets drop.

The total return approach strikes a balance between sustainability and cash flow, since clients are invested for growth and income in their portfolios.

The results

Over the years, we have seen that the total return approach plus strategic tax planning results in higher ending total wealth for retirees. It also provides more reliable cash flow, especially as decreases from one income source are offset by increases from another.

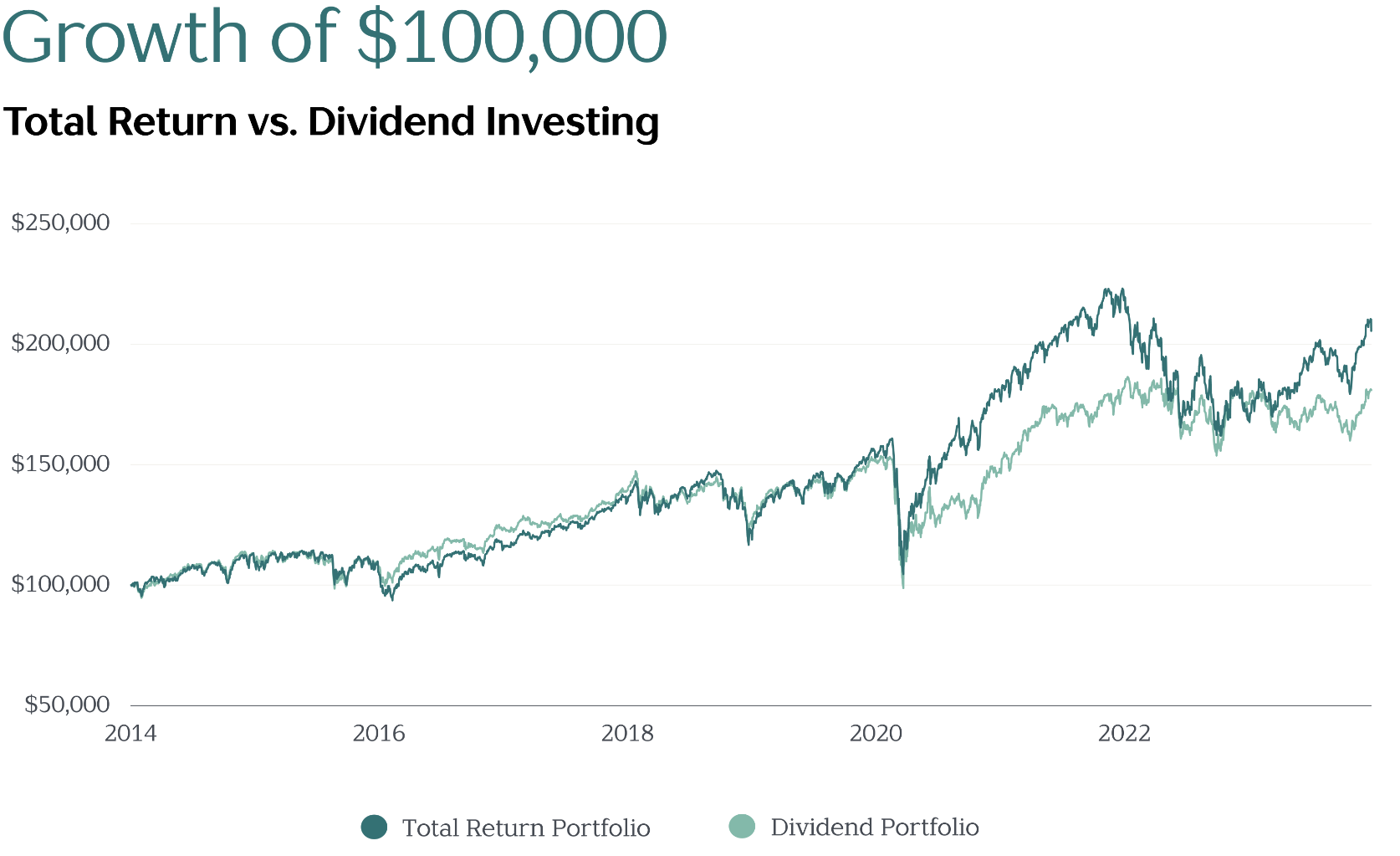

Let’s look at this in action. We compared two $100,000 portfolios. The first portfolio (green line) is invested in a U.S. total market index fund, while the second (blue line) is invested in U.S. dividend-paying stocks only.

- Portfolio #1 – Invested in a U.S. total market index fund (VIT)

- Portfolio #2 – Invested in U.S. dividend-paying stocks only (VYM)

Using Portfolio #2 as a proxy, we looked at the cash flow generated each year. When cash flow from Portfolio #1 fell short of the cash flow generated in Portfolio #2, we sold appreciated assets in Portfolio #1 to make up the difference and create more consistent cash flow for our client.

We compared a portfolio using the total returns approach versus a portfolio using only the Vanguard High Dividend Yield ETF (VYM), which was chosen for comparison because it is a low-cost way to access high-dividend-paying stocks. For illustrative purposes only.

Since the total cash flow withdrawn from both portfolios was the same, it made it easy to compare the ending wealth of the two strategies. Portfolio #1 ended the period with a value of $205,000, while Portfolio #2 had an ending value of $181,000.

The story is similar if we add an international total market fund (VEU) and an international dividend-paying fund (VYMI) to the mix and rebalance annually. The portfolio consisting of VTI and VEU outpaces the dividend-only portfolio after adjusting for withdrawals.

The takeaway? We see that focusing on total return not only matches the level of income generated by conventional approaches but also results in higher ending total wealth.

The total returns approach can also provide more reliable cash flow, as decreases in bond income are offset by increases in income from dividends and capital gains (and vice versa). When income dips, investors can access principal to keep cash flow stable.

Total return and tax planning

While we have found the total return approach can produce increased cash flow for retirees, we have also found it offers better tax efficiencies. This is because we never take a “set-it-and-forget-it” attitude toward distributions. Instead, we strategically take distributions from a mix of account types. We also consider selling assets at a loss where possible to offset capital gains, based on retirees’ total income, tax bracket, and cash flow needs.

For example, let’s say Mr. Johnson inherits $100,000 in tax-deferred funds. He also relies on income from his 401(k), pension, and Social Security, plus has a significant sum in non-taxable savings. In this case, we may increase distributions from his savings and decrease distributions from the 401(k) to reduce tax liability. We may also recommend selling some assets during a market downturn to offset income with capital losses.

Or consider Ms. Smith, who has realized significant losses in her portfolio during a market downturn. However, she owns other appreciated assets; this may be a good year to sell those assets since her earlier losses will almost entirely offset gains.*

Required minimum distributions (RMDs) will also be a factor in tax planning. Account owners over the age of 73 must take distributions from their tax-deferred accounts, and these are 100% taxable in the year they are taken. People who inherit IRAs or Roth IRAs may also have an RMD obligation to account for in the year they receive the funds.

In certain years, we may recommend offsetting taxes from RMDs by utilizing a Qualified Charitable Distribution (QCD). This option allows investors to send their RMDs directly to a charitable organization of their choosing. We might also consider selling depreciated assets to take advantage of capital losses or increase distributions from tax-free accounts to reduce the client’s overall tax liability.

Conclusion

The goal of a total return approach is to make sure retirees continue growing their assets while generating enough income to outpace their spending. In our experience, it’s a much more successful strategy than relying solely on dividend-producing stocks to cover cash flow.

As wealth management professionals and CPAs, we collaborate, educate, and guide clients as they make decisions that impact their lives decades into the future. We also work with clients to adjust their investment strategies amid shifting markets and changing life circumstances. By applying the total return approach, we are able to increase investors’ confidence that they won’t outlive their retirement savings.

Rob Greenman, CFP® is chief growth officer at Vista Capital Partners. He is a CFP® holder and a past president of the local Financial Planning Association. Alex Canellopoulos, CFA, CFP® is director of investments at Vista Capital Partners, where he conducts market and performance-related research, stays on top of market trends and academic studies, and simplifies portfolio construction while enhancing the investment experience for clients. Founded in 2001 in Portland, Oregon, Vista offers wealth management services to clients with $2 million or more to invest, including investment management, financial planning, and legacy planning. To learn more, visit www.vistacp.com

*For illustration purposes only.