CPA evolution explained: The CPA exam in 2023 and 2024

July 26, 2023

By Amy Napolski, Becker Professional Education

By now you’ve heard the CPA Exam will be changing — some may even say evolving. In fact, the change is called CPA Evolution.

This isn’t anything new (the last big exam change was in 2017); this change is just bigger than previous changes. Every five or so years, the American Institute of CPAs (AICPA) performs an analysis of the profession to make sure the exam is relevant, valid and current. CPA Evolution is a joint venture with the National Association of State Boards of Accountancy (NASBA) and the AICPA.

Let’s examine how the exam is changing and how to plan for the changes.

Candidates will have a choice

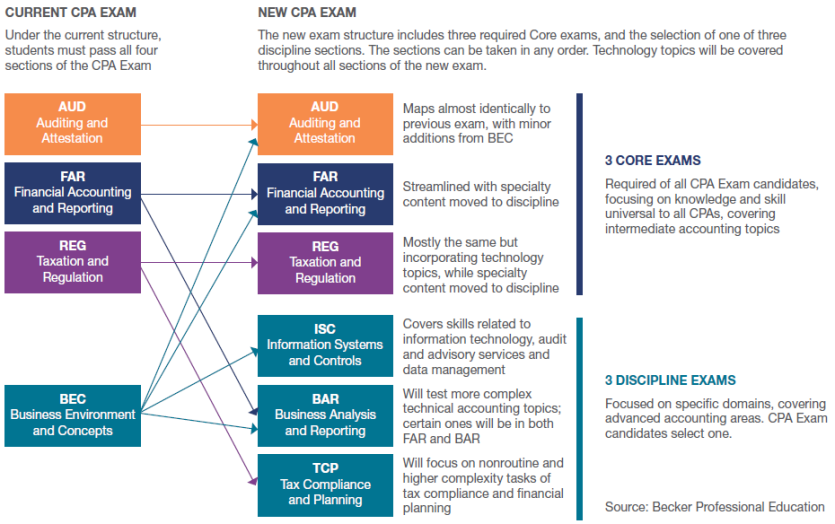

For the current exam, everyone takes the same four parts: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). Starting January 2024, candidates have a choice to make: All candidates will take three core exams — Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulation (REG). However, candidates will choose one of three discipline exams for the fourth exam: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), or Tax Compliance and Planning (TCP). The exams may be taken in any order.

The goal of the new model isn’t to award a specialized license, but to allow candidates to choose their path based on the area of accounting they plan to pursue or are currently pursuing. The core exams cover the essentials all CPAs need to know, while the discipline exams cover the more in-depth content of the specific areas in accounting.

It’s OK if candidates don’t know which discipline to choose

Individuals may or may not know the area they will be working in. This isn’t a problem because they will have a CPA license — not a specialized license — once they pass the exams and complete the other requirements for licensure.

Note: If a candidate fails a discipline exam, they may choose a different discipline for their next attempt.

Exams passed in 2023 will count in 2024

NASBA has provided a transition policy for candidates who may be taking exams in both 2023 and 2024. If you pass AUD, FAR or REG in 2023, those will still “count” for the corresponding core exams. If you pass BEC in 2023, it will count for a discipline exam.

What the changes look like in a nutshell

Another reason behind CPA Evolution is to address the issue of how much content is tested. The accounting profession changes at a rapid pace with new rules and regulations happening on an ongoing basis. That’s a lot of content for the exam so, with the core and discipline model, the candidate chooses the specific area (discipline) to be tested. Content for the current four exams is being moved around for the new six exams for 2024.

Other notable changes

• There will be no written communications tasks on the new exam.

• Authoritative literature will not be available as a searchable database. Excerpts will be provided for candidates to answer research questions.

• Microsoft Excel will be replaced with a generic equivalent with similar functionality: SpreadJS.

Dates to know for 2023 and 2024

NASBA and the AICPA released the following tentative application information and testing schedules for late 2023.

• Oct. 1, 2023: Application deadline for BEC exam first-time candidates applying through NASBA/CPAES.*

• Nov. 12, 2023: Application deadline for BEC exam re-exam candidates who have already been approved for a prior NTS (any section).*

• Nov. 22, 2023: NASBA will start processing applications for the new discipline exam sections (BAR, ISC, TCP).

• Dec. 15, 2023: Last day of testing for all sections of the current exam (AUD, BEC, FAR, and REG).

• Dec. 16, 2023–Jan. 9, 2024: No testing to allow for IT systems to convert to the new exam.

*These dates may be different for those states that the application is through their state board.

Key takeaways

• Jan. 10, 2024: Testing begins for the new exam.

• There will be five “black out dates” each quarter for the core exams.

• Testing for the discipline sections of the exam (BAR, ISC, TCP) will only be available for approximately one month each quarter.

Making a plan

• With all these changes it may be overwhelming for candidates to decide where to start. Here are some considerations:

• If possible, candidates should pass BEC in 2023 because this passed exam will “count” for a discipline exam in 2024.

• Exams that could be easier to pass in 2024 are FAR and REG because they are moving content from these sections. Now, if a candidate has time to pass all four in 2023, by all means, encourage them to do so!

• The AUD exam will remain pretty much the same in 2024.

• Candidates should use a calendar to map out a plan, taking into consideration the dates they can and cannot take the core and discipline exams.

It’s going to take longer to get scores in 2024

There will be a limited number of score release dates because the AICPA will need more time to evaluate and score the new exams.

What does this mean? Similar to what happened in 2017, candidates may take multiple exams before getting any scores, which may be nerve-wracking and may make planning difficult. The AICPA and NASBA are aware of this, so NASBA has proposed a credit extension policy that will impact the current 18-month window to complete the four parts of the CPA Exam. Many state societies and boards of accountancy, including the MNCPA and the Minnesota Board of Accountancy, are encouraging NASBA to extend this window to a longer period.

This policy would allow candidates who have passed any parts by Jan. 1, 2024, to have credit for those exams extended to June 30, 2025. The individual state boards of accountancy are in the process of adopting this policy. The states who have not adopted the policy need this change to move through the state legislatures, and NASBA is confident all states will eventually approve it.

Key takeaway

Encourage candidates to take exams even though they haven’t received scores. A candidate may have more than one exam on the Notice to Schedule (NTS), so they should continue to study and take parts already paid for.

Final thoughts for CPA Exam candidates

Change can be difficult, so let’s address that head on. Keep in mind that change can be advantageous, too, and encourage staff to use that as a mantra when navigating the CPA Exam: I will have a choice. Change is good. I will be successful. Taking time to stay on top of the changes coming in 2024 will increase confidence to persevere through the exams and navigate the process.

I wish your staff all the best during this exciting juncture in the profession. Just think — they’re part of making history!

Amy Napolski is a Becker Professional Education senior account manager. You may reach her at anapolski@becker.com.

This article was originally published in Footnote, the official magazine of the Minnesota Society of CPAs. It is used with permission.